What Are The Results Of Depreciation?

It Is an important course of for companies as it impacts both the steadiness sheet and the income assertion, finally influencing key monetary metrics similar to internet earnings and cash circulate. While depreciation does not instantly impression cash flow—since it’s a non-cash expense—it does scale back taxable earnings, which can result in tax financial savings and thus affect money circulate indirectly. The alternative of depreciation technique can considerably alter the monetary portrayal of a company, making the choice a strategic decision that goes past mere compliance with accounting standards.

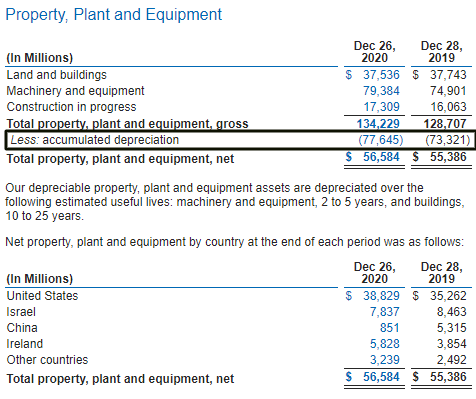

Whereas the salvage value could also be based mostly on market situations or the asset’s condition, it is generally a small amount compared to the initial cost. This methodology is particularly helpful for assets like equipment or vehicles that have variable usage charges and whose worth decreases with elevated use. Learn what accumulated depreciation is, and the method to calculate and record it on the balance sheet.

Importance In Monetary Reporting

A widespread variation is the double-declining balance methodology, the place the straight-line depreciation price is doubled. Using the same $10,000 machine with a 5-year life, the straight-line fee would be 20% (1 / 5 years). In subsequent years, the rate is applied to the asset’s guide value (cost less accrued depreciation). Keep In Mind that the query of does depreciation go on the revenue assertion is vital to understanding monetary reporting.

Depreciation: The Depreciation Dilemma: Its Impression On Ebit And Internet Earnings Defined

Earnings before curiosity, taxes, depreciation, and amortization (EBITDA) are one other financial metric that can be affected by depreciation. It is calculated by including interest, taxes, depreciation, and amortization to internet earnings. Typically, analysts will look at every of those inputs to know how they are affecting money move. Return on fairness (ROE) is a vital metric that’s affected by mounted asset depreciation. This affects the value of fairness since belongings minus liabilities are equal to equity. General, when property are substantially dropping value, it reduces the return on equity for shareholders.

- This disclosure should include the amount of depreciation expense, the strategy of calculation, and the property to which it relates.

- Can anyone help me perceive, conceptually, why we add the depreciation expense to net revenue on the money flow statement?

- An income assertion with depreciation expense is a robust software for evaluation, and by mastering its analysis, you’ll be higher equipped to unlock the secrets and techniques of economic reporting.

- The numerous methods used to calculate depreciation embrace straight line, declining balance, sum-of-the-years’ digits, and units of manufacturing, as defined below.

It is what is named a contra account; in this case, an asset whose pure steadiness is a credit score, as it offsets the unfavorable value steadiness (debit) of the asset account it’s linked to. Accountants concentrate on the methodical distribution of an asset’s cost and ensuring compliance with accounting standards. In this example, the net book worth of the asset is $4,000, which provides a extra accurate representation of its price after contemplating both depreciation and potential income from its disposal.

As Quickly As an asset has been impaired, the depreciation calculation for future durations should be adjusted. The revised carrying amount becomes the model new base for calculating depreciation, and the asset’s remaining helpful life may also need to be reassessed. This ensures that future depreciation expenses accurately mirror the asset’s present value and its remaining useful life. Depreciation plays a unique role in tax accounting compared to monetary reporting. Governments typically allow businesses to make use of particular methods of depreciation for tax purposes, which can differ from the techniques used within the company’s books. Understanding the variations between book depreciation and tax depreciation is crucial for correct tax planning.

While depreciation is a non-cash expense (meaning no cash is actually spent), it still lowers taxable earnings and the company’s overall profit. Tracking the depreciation expense of an asset is important for accounting and tax reporting purposes as a outcome of it spreads the cost of the asset over the time it is in use. An accelerated depreciation technique charges a bigger amount of the asset’s price to depreciation expense in the course of the early years of the asset.

Revaluation is the method of adjusting the recorded value of an asset to replicate its current market worth. This course of can influence the amassed depreciation and the overall monetary statements of the corporate. A depreciation expense has a direct effect on the revenue that appears on a company’s earnings assertion. The larger the depreciation expense in a given yr, the decrease the company’s reported net income – its revenue. Nonetheless, because depreciation is a non-cash expense, the expense would not change the corporate’s cash circulate.

By claiming depreciation, companies can free up money that would in any other case be paid in taxes and reinvest this money into their operations. Continuing with the earlier instance, the $10,000 annual depreciation expense would scale back the company’s pre-tax income by the same quantity. If the company had a pre-tax revenue of $50,000, after accounting for depreciation, the web income can be $40,000. This discount in web revenue can affect the corporate’s valuation and its capability to draw investment. For example, if an organization purchases a chunk of apparatus for $100,000 with a helpful life of 10 years, it may possibly declare a depreciation expense of $10,000 annually. Assuming a tax fee of 30%, this interprets to a tax saving of $3,000 per 12 months, thereby improving the company’s cash move by that amount.

If the corporate makes use of straight-line depreciation, it’s going to claim https://www.simple-accounting.org/ a depreciation expense of $10,000 each year, decreasing its taxable earnings by the same quantity. If the company’s tax price is 30%, this translates to a tax saving of $3,000 annually. E-book depreciation refers to the depreciation calculated for monetary reporting purposes, whereas tax depreciation is used to calculate taxable income.

Depreciation on the income statement is an expense that impacts the company’s earnings statement, reducing the working earnings. The total depreciation is then listed as a line merchandise on the company’s stability sheet, subtracting from the book worth of the long-term asset. The amount of depreciation is reported on the income statement under operating expenses.