Benefits of a Business Card

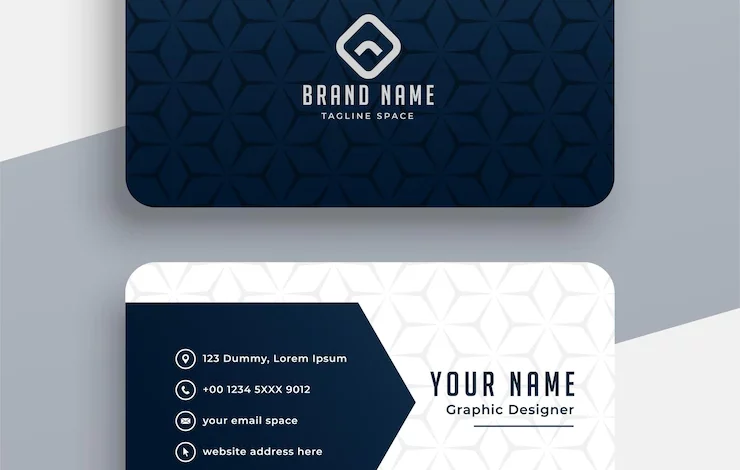

Businesspeople and company executives rely heavily on their business cards to make an excellent first impression on potential customers and clients. An attractive business card may significantly impact a company’s public image. Each company employee should approach custom business card printing services so they can conveniently pass their info to clients who aren’t familiar with them. All business owners rely on business card printing services to sell and promote their company’s services or products. You should include the relevant information about your organization, logo, and name (with designation) in your business-to-business vehicle. Paper quality is critical when printing these cards because they are a part of your business and will represent that firm’s status.

Ads That Aren’t Too Expensive

The low cost of business cards is an obvious advantage. Business cards are a great alternative if you’re looking for a low-cost way to get your name out there.

Despite their modest cost, business cards are an effective marketing tool for attracting new customers. A stack of business cards may reach as many prospective customers as a billboard and are more likely to create a lasting impression due to the nature of a physical card.

It’s Ideal for Special Occasions

A business card strategy will be highly advantageous if your organization frequently attends networking events or trade exhibits. Make sure your brand name is something people remember when they return to their homes.

Make sure anyone who wants your contact information can easily find it by setting a stack of business cards on your desk or table.

Observable and Measurable

A tangible thing like a business card has a lot of significance in the digital world. So having a well-designed business card that you can hold in your hands rather than relying on bulk email and SMS marketing is good.

A physical reminder of your company’s existence, such as a business card, is considerably more likely to be remembered than an electronic one.

Easy Distribution

Distributing business cards is another perk of having them. In addition to distributing them in person, you can also leave them in public places like coffee shops or even post them on a wall. You can easily spread the word about your firm with the help of custom business card printing.

After meeting someone for the first time, it’s common practice to exchange business cards. This is an excellent approach for a small firm to expand its network.

People Won’t Forget Your Email

The last thing you want to find at a conference is a company you’re interested in, but no method to contact them after you get home. Companies might be losing out on many new customers because of this atrocity.

You may ensure that no one forgets your vital information by handing out a card.

The First Impression Is Everything

The level of professionalism that business cards represent is all too frequently neglected. For many years, exchanging business cards has been widely accepted as a sign of professionalism and sincerity.

Conclusion

Business cards may no longer be effective since they end up in the garbage, but these are the same people who are not utilizing them correctly. They leave networking gatherings after exchanging business cards, believing they’ve accomplished their goal of making small conversations. This is not the best use of business cards. Custom business card printing is just as effective as the situations in which you distribute them and the people you engage with, so don’t waste time learning about them. People are more likely to keep your business card if they have meaningful talks with you and engage you in conversation.