Allowance For Doubtful Accounts: Information + Calculations

So, based mostly on accrual accounting, we have to cross an entry stating that there may be unhealthy debts shortly. Grasp the basics of economic accounting with our Accounting for Monetary Analysts Course. This complete program provides over sixteen hours of expert-led video tutorials, guiding you through the preparation and evaluation of income statements, steadiness sheets, and money circulate statements. Gain hands-on expertise with Excel-based financial modeling, real-world case research, and downloadable templates. Upon completion, earn a acknowledged certificate to boost your profession prospects in finance and funding. A firm can use statistical modeling corresponding to default probability to determine its anticipated losses to delinquent and bad debt.

Workers coaching packages ought to emphasize how to recognise signs of potential customer defaults, together with late payments and modifications in customer behaviour. Additionally, workers should understand the procedures for calculating the allowance for doubtful accounts and recording ledger adjustments. This information permits groups to reply proactively to emerging risks and preserve accurate monetary data. Trends in doubtful accounts present actionable insights into the effectiveness of credit score insurance policies and customer management strategies. For example, a rising proportion of dangerous money owed could signal the necessity for stricter credit score assessments or improved fee assortment processes.

Recognise The Tax Implications Of Bad Debt Write-offs

Writing off uncollectible accounts affects each the income statement, the place it is recorded as an expense, and the balance sheet, the place it reduces the entire receivables. Even although the accounts receivable isn’t due in September, the corporate still has to report credit score losses of $4,000 as unhealthy debts expense in its revenue statement for the month. If accounts receivable is $40,000 and allowance for credit score losses is $4,000, the web amount reported on the steadiness sheet shall be $36,000.

This transaction would not affect particular person customer accounts—every customer still formally owes its full stability. As An Alternative, it creates a pool of anticipated losses that sits on the balance sheet, decreasing the general reported value of AR from $1.5 million to $1.425 million. Since a small percentage of consumers typically symbolize a big portion of receivables, some companies make use of Pareto analysis (the 80/20 principle). They focus their estimates on main accounts that constitute most of their receivables. Figuring Out the right amount to set aside for potentially uncollectible invoices requires each art and science. Corporations should select a way that balances accuracy with being practical, contemplating their industry, buyer base, and available data.

Be Part Of the 50,000 accounts receivable professionals already getting our insights, greatest practices, and tales every month. Discovering an accountant to manage your bookkeeping and file taxes is a giant choice. Regardless Of our efforts, this info may not be up to date or applicable in all circumstances. Any reliance you place on this data is therefore strictly at your personal threat.

Accounting Ideas Board (apb)

When it comes to business longevity, consistent cash circulate, effective stock administration, and correct… The buyer danger classification technique works greatest if you have https://www.simple-accounting.org/ a small and stable buyer base following similar credit score cycles. If your buyer base grows, think about adopting one of many earlier strategies since they’re going to be easier to implement. The AR growing older technique works best when you have a big buyer base that follows a quantity of credit cycles.

How To Record An Allowance For Uncertain Accounts Journal Entry

The Allowance for Doubtful Accounts is a contra-asset account that represents the estimated amount of receivables that an organization doesn’t anticipate to gather. It is used to adjust the accounts receivable steadiness on the steadiness sheet to reflect the online realizable worth of receivables. The allowance technique reduces the carrying value or realizable worth of the receivables account on the balance sheet.

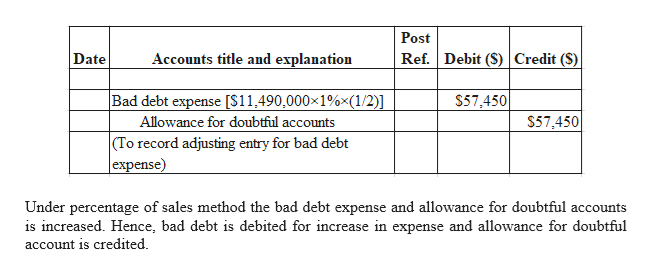

If this quarter’s credit score sales complete $500,000, it would report a $10,000 addition to the allowance for doubtful accounts and a corresponding $10,000 dangerous debt expense. The allowance for doubtful accounts is an amount a enterprise sets aside to cowl potential losses from unpaid invoices. It Is not precise cash you lose proper now, however an estimate of what you anticipate some customers won’t pay sooner or later. Increases in allowance for credit score losses are also recorded as unhealthy debt expenses on the revenue statement. Transparency in monetary reporting builds trust with stakeholders and helps businesses meet regulatory requirements.

These calculations use historic data from both the business and the industry. Automation can streamline credit management processes, enabling sooner identification of overdue accounts. AI can analyze customer fee patterns and predict which accounts are more doubtless to turn out to be uncertain, permitting for proactive intervention. Allowance for uncertain accounts helps you anticipate what proportion of your receivables will be uncollectible.

- An account that lowers the worth of a related account is named a contra account in a basic ledger.

- This failure can stem from numerous causes, together with monetary or corporate insolvency, bankruptcy, or disputes concerning the services or products provided.

- Uncertain accounts, also referred to as dangerous debt or uncollectible accounts, are accounts receivable that an organization believes it might not gather in full or in any respect.

- Corporations apply a flat percentage to their credit score gross sales for the period based mostly on historical collection rates.

- Anticipating future bad money owed requires a deep understanding of the market, customer behaviors, and total economic tendencies.

In accounting, dangerous debt is handled as an expense because it represents a lack of income. Companies should manage this risk effectively to take care of monetary stability and guarantee accurate monetary reporting. Managing unhealthy debt is a crucial facet of monetary strategy, affecting each short-term money flow and long-term profitability. Correct monetary reporting requires maintaining an allowance for doubtful accounts.